Financial Freedom 2025 Achieve financial freedom in 5 steps – pulse financial planning

Hey there! Let’s talk about something that’s on all our minds—financial freedom! It’s a goal many of us strive for, and it’s all about taking control of our financial future. Imagine living life on your own terms, without the constant stress of bills and debts hanging over your head. In this journey, visual inspiration can keep us motivated, and I’ve got some great images to share that encapsulate the essence of financial freedom. Let’s dive in!

Visualizing Success

Here’s a striking image that perfectly captures the essence of financial triumph. The joy radiating from this businessman as he spreads money in the air signifies the liberation that comes with achieving financial goals. It symbolizes the wealth of experiences, opportunities, and freedom that a solid financial foundation can bring. Financial success isn’t only about the riches; it’s about the peace of mind and security that allows us to truly enjoy life. This image serves as a reminder to aim high and keep hustling toward our dreams.

Steps to Achieve Financial Freedom

This next image evokes a sense of calm and clarity—a reminder of what financial freedom feels like. In its tranquility, we can see the potential that comes with meticulous financial planning. The pathway to financial independence isn’t always easy, but by taking strategic steps and planning diligently, we can pave our way to a secure future. This is where knowledge becomes power: understanding how to budget, save, and invest wisely will unlock doors we never even knew existed.

So, let’s get into those crucial steps! First, always keep your eyes on the prize. The journey to financial freedom starts with setting clear financial goals. Ask yourself: What does financial freedom mean to you? This could mean being debt-free, having a solid savings plan, or even being able to retire comfortably. Write it down—these goals will be your guiding stars!

Next up, let’s talk about budgeting. A well-planned budget allows you to control your spending and make informed decisions. Track your income and expenses, and categorize them as needs versus wants. Being conscious of how you spend your money is a step toward financial discipline. Utilize budgeting tools and apps if it makes it easier for you to stick to your plan.

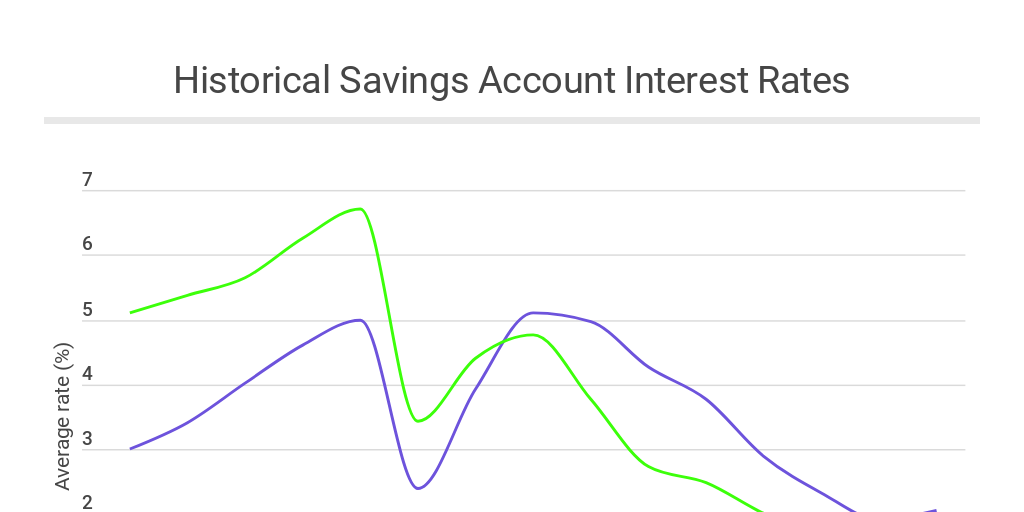

Now, onto the importance of saving! Whether it’s for an emergency fund, a vacation, or even retirement, saving is non-negotiable. Aim to save a portion of your income every month. Even small contributions can accumulate into substantial savings over time. Compound interest is a powerful force, and the earlier you start saving, the more you’ll benefit! Set up an automatic savings plan to make things seamless. You won’t miss what you don’t see!

Then, there’s the crucial part of investing. While it might sound scary, investing is key to building wealth. Start learning about different investment vehicles like stocks, bonds, mutual funds, or real estate. Diversifying your portfolio is essential—don’t put all your eggs in one basket! With a little research and strategy, you can set yourself up for greater returns on your investments, allowing your money to work for you.

Let’s also not forget about debt management. If you’re carrying debt, tackle it head-on. Not all debts are created equal, so prioritize paying off high-interest debts first while maintaining minimum payments on others. There are various strategies—like the snowball method (pay off the smallest debts first) or avalanche method (pay off the debts with the highest interest rates) that can support you in this journey. Every step you take brings you closer to freedom!

Lastly, surround yourself with knowledge. Whether through personal finance books, podcasts, or workshops, continuously educate yourself. Financial literacy is crucial—understanding how money works empowers you to make informed decisions. Seek mentorship or join groups where discussions around financial growth and stability happen. Growth often comes from shared experiences and learning from those who have paved the path ahead of you.

Remember, financial freedom is not just a dream; it’s a journey. Stay motivated, seek inspiration, and never underestimate the power of community. Celebrate every little victory along the way—whether it’s paying off a credit card or reaching a savings milestone. Each achievement deserves recognition and should fuel your motivation to keep pushing forward.

As we wrap this up, take a moment to reflect on what financial freedom looks like for you. Picture your dreams, your goals, and understand that achieving them is within your reach. With determination, strategic planning, and a dash of patience, the path to financial independence can indeed become a reality. Let these images serve as your daily reminders of what you’re working toward, and may they inspire you to keep climbing those financial mountains.

Keep hustling, keep growing, and let’s achieve that financial freedom together!