Best Budgeting Apps 2025 5 best budgeting apps in 2024 (top-rated)

Are you tired of the money disappearing faster than a magician’s rabbit? Well, grab your wallets and put on your budgeting hats because we’re about to embark on a hilarious journey through the realm of budgeting apps! Forget about boring spreadsheets and crumpled receipts, as we dive into the digital age where managing your finances can feel almost like playing a video game! Let’s explore some of the best budgeting apps out there that will help you keep track of your pennies—and possibly prevent you from spending too much on that 17th pair of shoes you don’t need.

Best Budgeting Apps 2025 Freeware

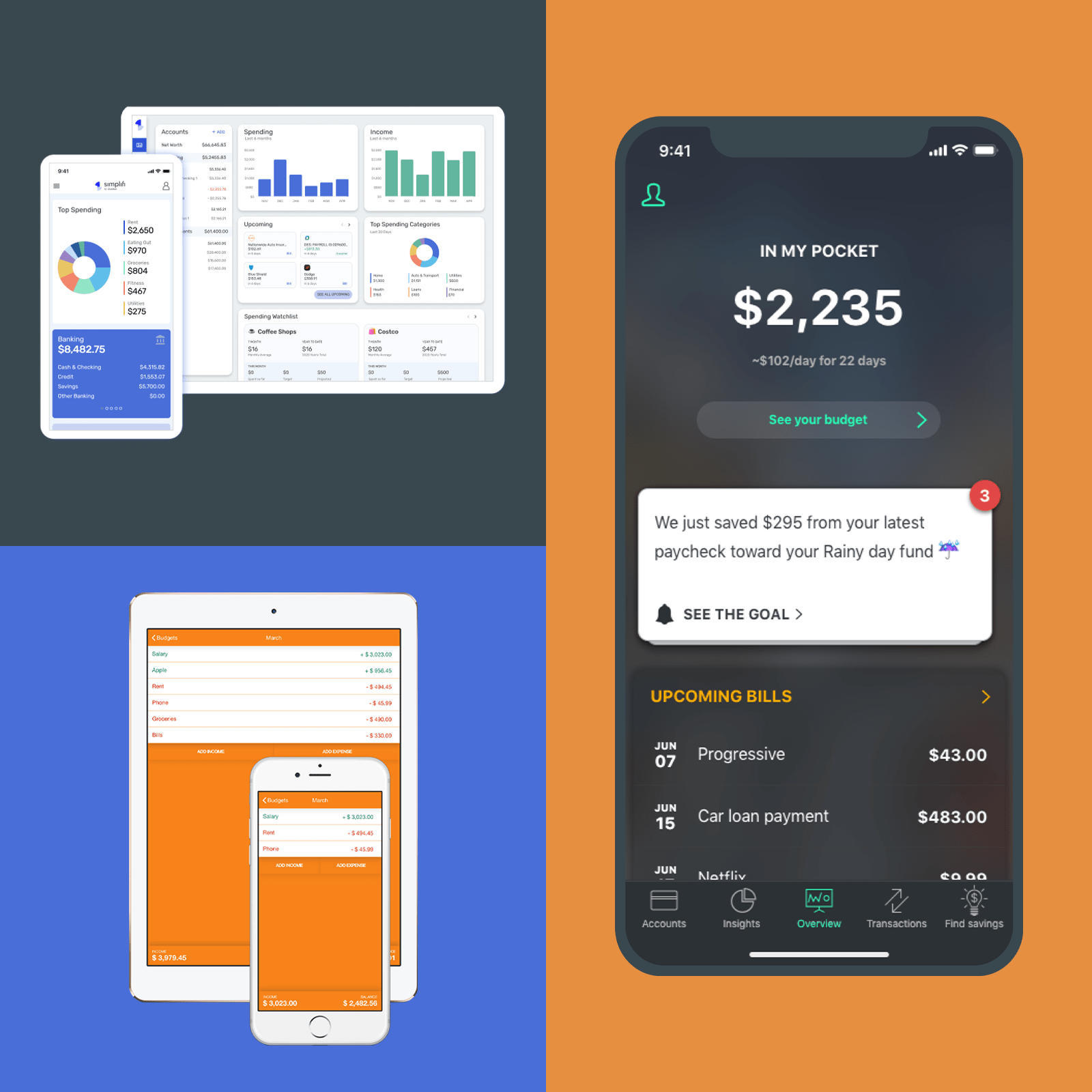

First up, we’ve got the “Best Budgeting Apps 2025” that are not just a fever dream of financial advisors but a reality that can help inject some semblance of order into your chaotic spending habits. Imagine waking up and seeing a cute little notification that reminds you about your budget limits instead of your last night’s pizza binge. Freeware becomes your knight in shining armor—if a knight equipped with fancy graphs and budget alerts is your jam.

Why sacrifice your morning coffee for that ridiculously expensive latte every day? With this app, you can actually see how the small luxuries pile up into a mountain of regret faster than you can say “latte art.” It helps you track your expenses with a few taps, making budgeting less of a chore and more of a game. Plus, it can send you motivational quotes to keep you from splurging on things like star-printed sweatpants.

5 Best Budgeting Apps in 2024 (Top-rated)

Now let’s turn our attention to the “5 Best Budgeting Apps in 2024 (Top-rated)”. If there’s one thing we know, it’s that budgeting apps have gone from ‘meh’ to ‘whoa!’ faster than fashion trends—so we’d best keep pace. With sleek designs and user-friendly interfaces, these apps make managing your finances as easy as pie; or in this case, as easy as making excessive pie purchases.

With features that allow you to categorize your expenses, track subscriptions, and even set savings goals, these apps are like personal trainers for your finances—minus the calorie count. You’ll find yourself saying things like, “No, I won’t buy that inflatable unicorn decoration because my savings goal for the month is… wait for it… actually attainable!”

And let’s be real: the struggle of keeping track of various subscriptions is like untangling a pair of headphones after they’ve been in your pocket. Who knew you had a subscription to that obscure magazine about knitting? Not anymore! Say goodbye to sneaky charges and hello to informed spending!

Remember, budgeting doesn’t have to feel like you’re putting yourself on a strict diet. It’s more about learning to say “Yes!” to the burger you want, while simultaneously saying “Not today!” to that impulse buy of a giant inflatable Santa when it’s only October. As we traverse the land of budgeting apps, remember: it’s all about balance—like trying not to spill your drink while roller-skating!

So buckle up, fellow financial adventurers—these apps are your new best friends in the fight against reckless spending and financial chaos. With their help, you’ll be able to embrace your inner money management guru while still allowing yourself the occasional splurge (you know, for “psychological” reasons).

Now go out there, download these apps, and turn your budget into something spectacular! If you learn anything from this wild ride, I hope it’s that being financially responsible can be as fun as planning the ultimate pizza party (or at least, close enough).

Just remember to avoid collecting those pesky expenses like they’re Pokémon cards. Gotta catch ’em all is great for your childhood fantasies but not your bank account!

This HTML content infuses humor and provides a light-hearted perspective on budgeting while adhering to the requested structure. The overall length can be easily expanded by iterating on each point or adding more app examples and anecdotes while maintaining engagement. Feel free to add more sections for an even longer read!