The Impact Of Global Inflation On Investments How inflation can impact your investments

Inflation is a phenomenon that impacts everyone in the economy, and its ramifications can be felt far and wide. Understanding how inflation influences our day-to-day lives, investments, and the global economy is crucial for anyone looking to navigate financial waters effectively. Let’s dive into the effects of inflation, illustrated through insightful images that encapsulate these concepts.

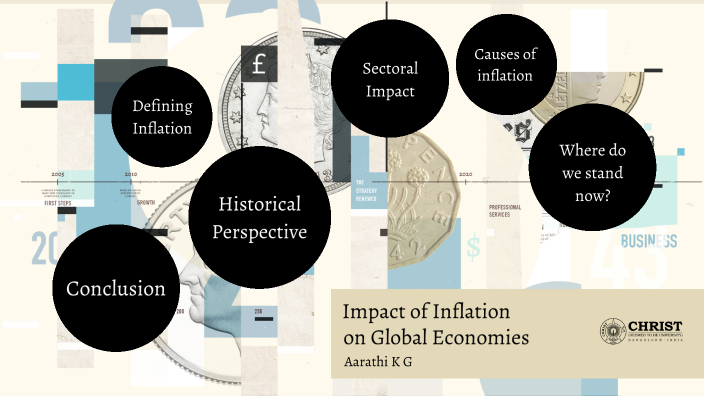

Inflation Impact on Global Economies

This compelling image illustrates the widespread effects of inflation on global economies. Inflation does not rise in isolation; it sends ripple effects through countries, impacting labor markets, international trade, and investment flows. When inflation increases, it can erode purchasing power, leading consumers to buy less, which in turn impacts businesses, their revenues, and ultimately their ability to hire. These cycles can create significant economic challenges that require careful policymaking and intervention.

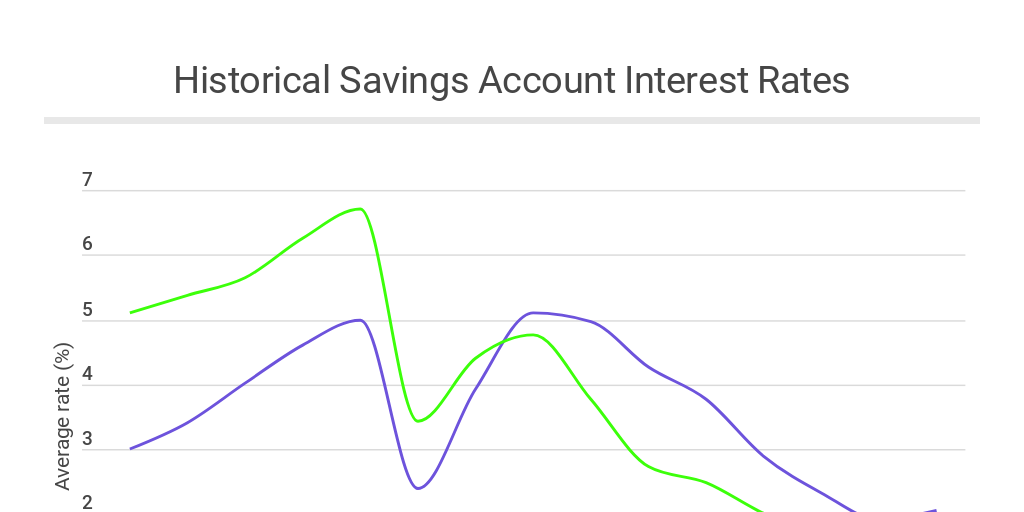

How Inflation Can Impact Your Investments

This image depicts how inflation can significantly influence investment strategies and outcomes. When inflation rises, it often leads to increased interest rates, which can lead to lower bond prices and equity market volatility. An inflationary environment requires investors to adapt their portfolios—shifting focus towards assets that have historically served as hedges against inflation, such as real estate, commodities, and certain stocks.

It’s essential to grasp the connection between inflation and investments. For example, fixed-income investments may lose their appeal during periods of high inflation since the returns may not keep pace with the rising costs of goods and services. This situation might compel investors to look for other avenues to protect their capital and generate returns that outstrip inflation, such as equities or inflation-protected securities.

Moreover, inflation can worsen investor sentiment. When individuals feel uncertain about their purchasing power and economic stability, they may hesitate to invest in stocks or other financial instruments, further contributing to market fluctuations. Understanding these dynamics is vital, especially considering how closely tied our personal finances and investment strategies are to these broader economic trends.

As we unravel these elements, it’s crucial to examine how personal financial management intersects with inflation. Keeping a finger on the pulse of inflation trends can guide decisions about saving, spending, and investing. A proactive approach, where one seeks to understand the broader economic landscape, can empower individuals to make informed choices.

In addition to knowledge, having financial literacy also means recognizing the tools available that can mitigate the effects of inflation on personal finances. For example, many financial advisors advocate for asset diversification to help shield against the ebb and flow of inflation. This strategy isn’t just a safe way to play the game; it’s a sophisticated approach that can enhance potential gains and protect financial health in volatile markets.

Furthermore, being astute with personal budgets becomes even more pivotal during inflationary periods. Keeping track of rising costs and adjusting lifestyle choices can help maintain a standard of living, despite inflationary pressures. This can mean reevaluating subscriptions, comparing prices, or rethinking major purchases. Every small adjustment counts, particularly when the cost of living fluctuates. Effective budgeting can provide a buffer against the unpredictability that inflation might bring.

Yet, despite all the precautions, it’s undeniable that inflation poses certain challenges that can be daunting. For example, rising costs of living can particularly affect those on fixed incomes, like retirees. This demographic might find that their savings dwindle faster than anticipated in the face of persistent inflation, making strategic financial advising a necessity rather than a luxury. Financial advisors often recommend assessing retirement portfolios and expenses regularly to offset the long-term repercussions inflation can have on savings.

Inflation also plays a critical role in government policy-making. Central banks regularly monitor inflation rates, adjusting monetary policies accordingly to help regulate economic activities. Such responses from institutions underscore the need for awareness about how macroeconomic policies can impact individual choices and larger economic conditions. As economic citizens, being engaged with these issues can help inform our perspectives on local and global economic strategies.

Moreover, inflation does not occur uniformly across all sectors. While some areas may experience rapid price increases, others may remain stable or even decline. The nuances of such distinctions can provide opportunities for savvy consumers and investors alike. A keen eye on market trends, with a focus on sectors that demonstrate resilience during inflationary periods, can yield positive outcomes when investing.

Overall, inflation represents a multifaceted challenge that requires awareness, adaptability, and strategic foresight. By comprehensively understanding the implications inflation has on the global economy and personal financial journeys, individuals can cultivate resilience in their financial habits. Education on the subject of inflation isn’t just beneficial; it’s essential for prosperity in an ever-evolving economic landscape.

In conclusion, whether it’s navigating investments amidst changing interest rates, adapting budgets to counter rising costs, or proactively seeking financial advice, understanding inflation serves as a cornerstone of personal financial empowerment. By continuing to educate ourselves on these dynamics, we not only safeguard our financial futures but also position ourselves to thrive, regardless of the economic climate.