Real Estate Investment In Emerging Markets Emerging trends in real estate investment

As the landscape of real estate continues to evolve, staying informed about emerging trends and markets is critical for any savvy investor. The dynamic nature of the industry presents both challenges and opportunities, and understanding where to direct your focus can lead to substantial rewards. Here, we explore some key insights into emerging trends in real estate investment, and how to effectively find high-potential markets.

Emerging Trends in Real Estate Investment

The real estate market is perpetually evolving, shaped by numerous factors including economic shifts, demographic trends, and technological advancements. One significant trend is the increasing appeal of sustainable and eco-friendly properties. Investors are recognizing the value of green buildings, which not only contribute to environmental sustainability but also tend to attract more renters and buyers in a market that increasingly values sustainability.

Another trend to watch is the rise of remote work. The COVID-19 pandemic has reshaped the way we work, allowing many people the flexibility to work from anywhere. This shift has led to an increased demand for residential properties in suburban or rural areas as people leave crowded urban centers. As an investor, understanding these shifts can guide you to target markets that are experiencing a surge in demand due to lifestyle changes.

Additionally, technology continues to play a pivotal role in real estate investment. The rise of proptech (property technology) is transforming traditional practices, making processes more efficient for both property management and investment. Tools such as virtual tours, online transactions, and data analytics are providing investors with new ways to analyze markets and make informed decisions quickly.

How to Find Emerging Real Estate Markets

Finding an emerging real estate market requires a combination of research, intuition, and an eye for trends. Here are some strategies for identifying these high-potential areas:

First, demographic trends can provide insights into where the market is headed. Look for areas with population growth, job development, and infrastructure improvements. Regions experiencing an influx of new residents often present great opportunities for investments as demand for housing increases.

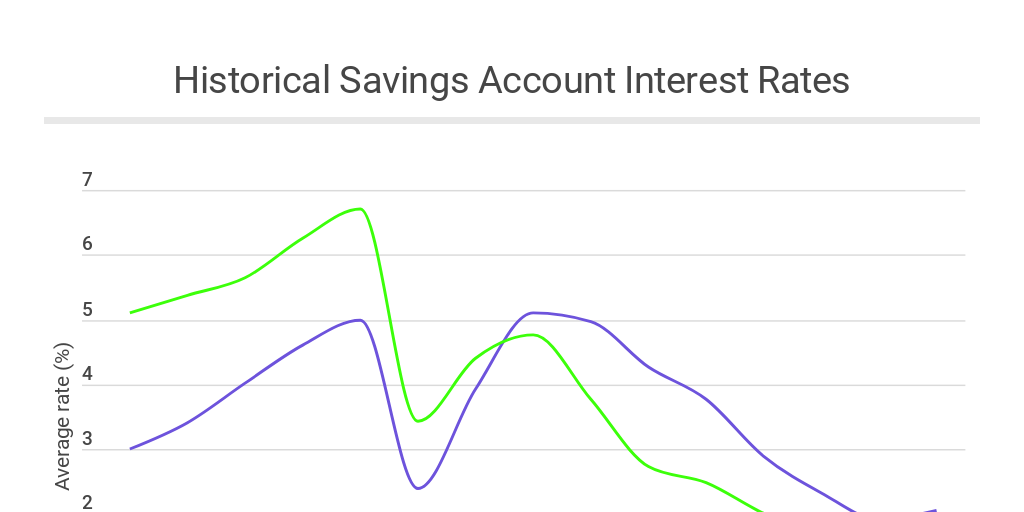

Secondly, pay attention to economic indicators. Analyze job growth reports and economic activity in various regions. Areas with increasing employment opportunities are generally poised for real estate growth. Local universities, hospitals, or tech hubs can signal robust economic potential.

Networking with other real estate professionals can provide valuable insights into upcoming markets. Engage with local industry groups, attend real estate conferences, and participate in online forums. These connections can lead you to lesser-known markets that are on the verge of becoming hotspots.

Furthermore, studying historical data can help you predict future trends. Review market cycles, pricing fluctuations, and investment performances in different areas. By understanding the past, you can better assess which markets may be worth your investment in the future.

Lastly, don’t overlook the impact of local government policies. Incentives for developments or changes in zoning laws can greatly influence market dynamics. Areas showing promise for new developments or tax advantages can provide lucrative investment opportunities.

In conclusion, the real estate market is rife with opportunities for those willing to stay informed and conduct diligent research. By identifying emerging trends and markets, you can position yourself advantageously in a continually changing landscape. Remember to evaluate multiple data sources, engage with fellow investors, and stay adaptable to the ever-evolving market conditions. Happy investing!