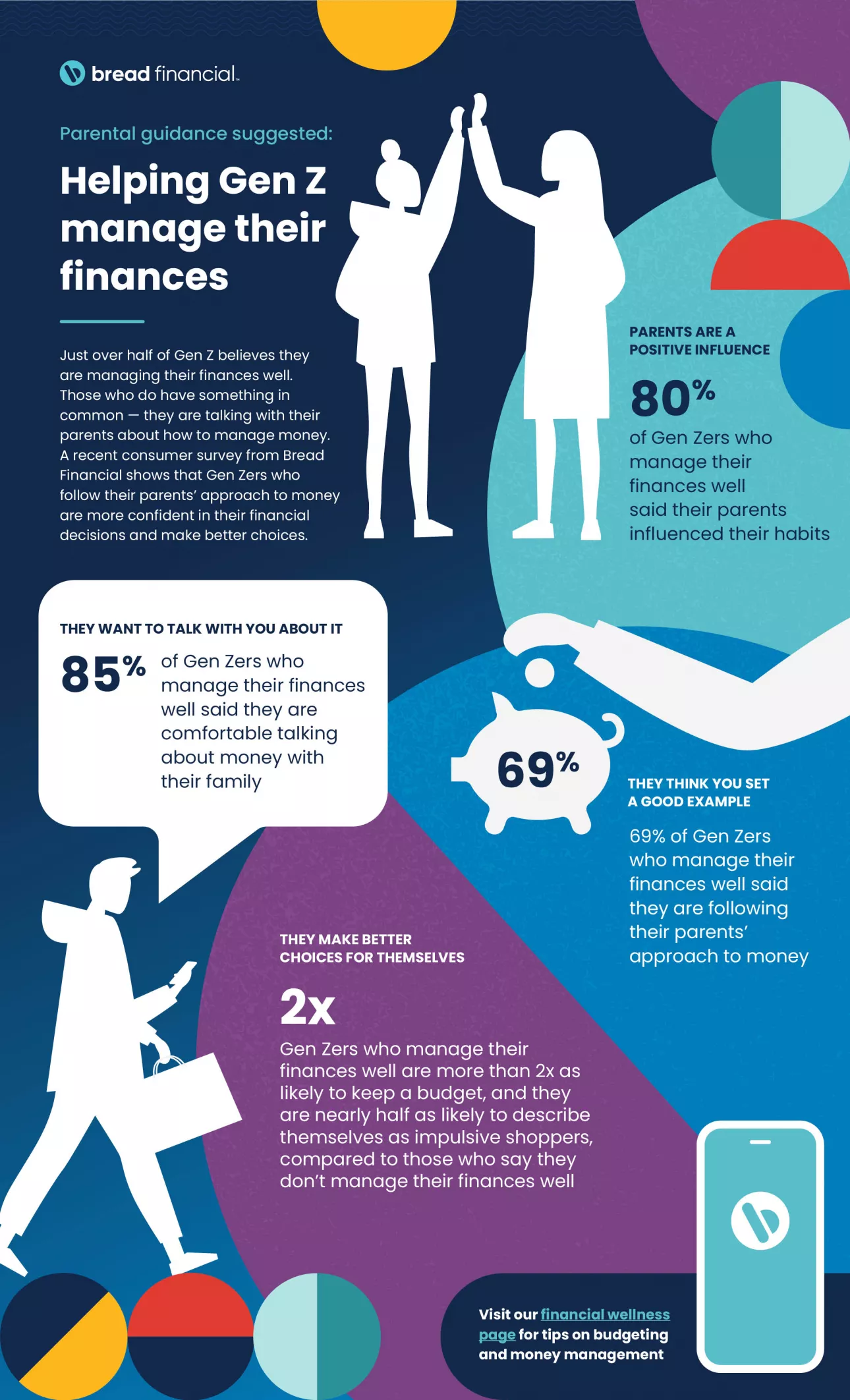

Financial Planning For Gen Z Helping gen z manage their finances

Welcome to the exciting world of financial literacy! As members of Gen Z, you are stepping into adulthood during an era marked by rapid change. Understanding how to manage your finances is not just a skill; it is a necessity. Navigating finances can be challenging, but it offers you the opportunity to build a secure future. This guide aims to provide valuable insights and resources to help you become financially savvy.

Understanding Financial Literacy

Financial literacy is the ability to understand and effectively use various financial skills, including personal finance management, budgeting, and investing. For Gen Z, becoming financially literate is crucial as you prepare to make life-changing decisions. From student loans to credit cards, understanding how each financial tool works can empower you to make informed choices and avoid common pitfalls.

Creating a Budget

The first step in managing your finances is creating a budget. A budget allows you to track your income and expenses, helping you understand where your money goes each month. Once you have a clear picture, you can begin to identify areas to cut back and prioritize saving. Start by listing your sources of income, followed by fixed expenses such as rent and utilities, then variable costs like entertainment and food. This process will not only help you live within your means but also allow you to allocate funds for savings and emergencies.

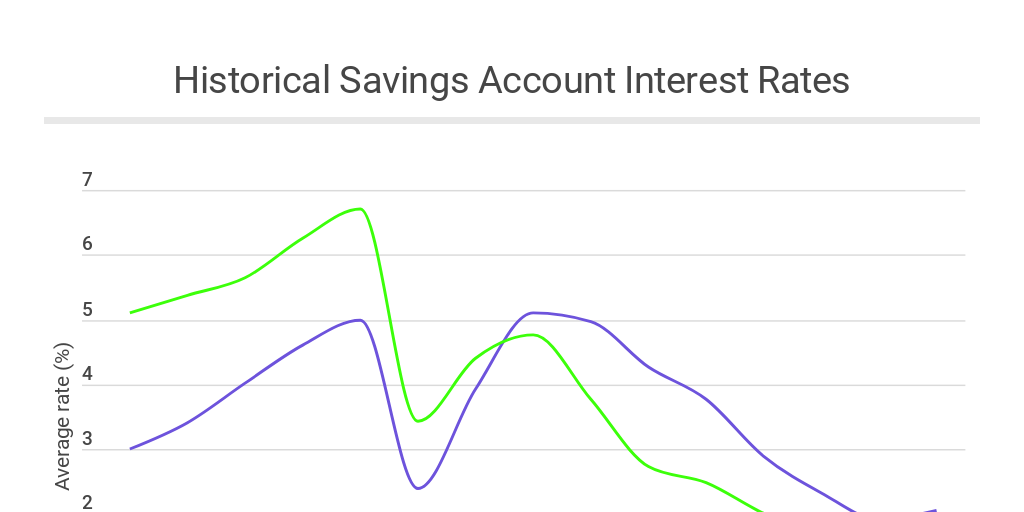

The Importance of Saving

Saving money may seem challenging, especially with the allure of spending in today’s consumer-driven society. However, prioritizing savings is essential for long-term financial security. Aim to create an emergency fund that covers three to six months of living expenses. Having this financial cushion can save you from stressful situations, such as unexpected medical bills or job loss. Additionally, consider starting a separate savings account specifically for goals such as travel, education, or a new car. Setting tangible goals can make saving feel more rewarding.

Understanding Credit

Credit plays a crucial role in your financial health. It can open doors, such as helping you secure loans for education or a car. However, mismanaging credit can lead to debt and damage your financial reputation. Begin by obtaining a credit card suited for beginners, ensuring you make timely payments to build a positive credit history. Aim to keep your credit utilization ratio low—ideally below 30%—to maintain a healthy credit score.

Investing for the Future

Investing may seem daunting, especially with all the complexities associated with it. However, it is a powerful tool for building wealth over time. Start by learning about different types of investment options, such as stocks, bonds, and mutual funds. Many platforms now offer user-friendly ways for young investors to begin their journey with minimal starting funds. Consider setting up a retirement account as early as possible; the earlier you start, the more time your money has to grow.

Understanding Debt

While it’s often necessary to take on some debt during your college years or to purchase a home, it’s crucial to understand how to manage it responsibly. Avoid high-interest debts like credit cards whenever possible. If you do find yourself in debt, create a repayment plan that focuses on paying off high-interest loans first. Be proactive about seeking financial advice if you feel overwhelmed; many resources are available to help you navigate your debt.

Finding Resources for Financial Education

The landscape of financial education is vast, with countless resources at your fingertips. Online courses, podcasts, and blogs dedicated to personal finance can provide valuable insights to guide you in your financial journey. Seek out reputable educational platforms like Coursera or Khan Academy that offer financial literacy courses, ranging from budgeting basics to advanced investment strategies. Additionally, many libraries offer free workshops and seminars aimed at developing financial literacy among young adults.

Utilizing Technology

The rise of technology has made personal finance management more accessible than ever. Consider using apps that help you track your expenses, set savings goals, and manage your investments. Apps like Mint can guide you in creating a budget, while investing platforms such as Robinhood allow you to start investing with little to no fees. Embracing technology can streamline your financial processes and keep you accountable.

Engaging with a Financial Advisor

If you’re feeling confused or overwhelmed, consulting a financial advisor can be beneficial. Many advisors cater specifically to young adults and can provide personalized insights based on your unique financial situation. An advisor can assist in creating a comprehensive financial plan, encompassing budgeting, saving, and investing strategies tailored to your goals.

Building Financial Habits

Developing good financial habits early in life will set the foundation for a secure future. Regularly review your budget and savings goals, and don’t be afraid to adjust them as your circumstances change. Financial habits, such as consistently saving a portion of your income or avoiding impulse purchases, will develop over time, leading to increased financial stability.

Conclusion

In conclusion, the journey toward financial literacy is an essential one for Gen Z. By understanding the basics of budgeting, saving, credit, and investing, you can lay the groundwork for a financially secure future. Embrace the resources available to you, whether through technology or educational platforms, and take proactive steps to develop good financial habits. Remember, the earlier you start, the more empowered you will be in your financial journey.

This HTML content provides a comprehensive guide to financial literacy for Gen Z, structured in a way that is informative and easy to read. The sections include images with appropriate alt text and follow a logical progression through various aspects of personal finance.