Financial Independence Early Retirement (FIRE) Movement Financial independence, retire early (fire) movement

The concept of financial independence has gained significant traction in recent years, particularly with the rise of the Financial Independence, Retire Early (FIRE) movement. This ideology encourages individuals to save aggressively, invest wisely, and ultimately reach a point where they can retire early, having built enough passive income to support their lifestyle. Let’s explore this movement and its strategies towards achieving financial freedom.

Understanding the FIRE Movement

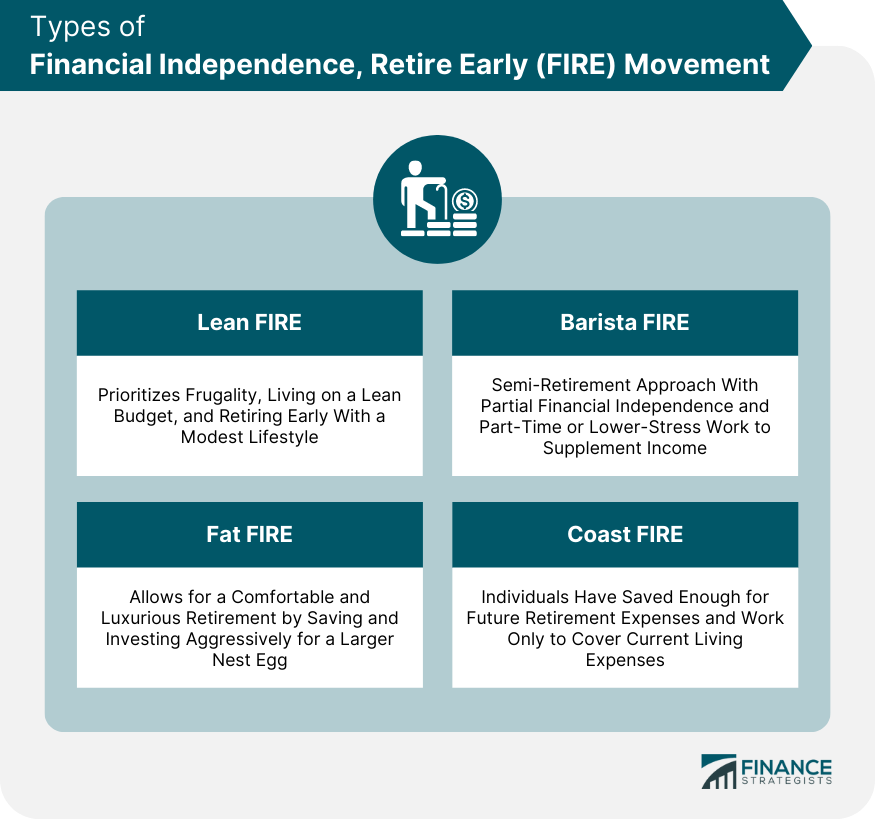

The FIRE movement is not just about retiring early; it’s about redefining how we view work, money, and life’s pleasures. Understanding the different types of financial independence is essential for anyone interested in this journey. There are various levels and approaches to achieving financial independence, whether it’s through extreme frugality, aggressive saving, or creating multiple income streams. This multifaceted approach allows people from different walks of life to find a pathway that suits their financial goals and personal values.

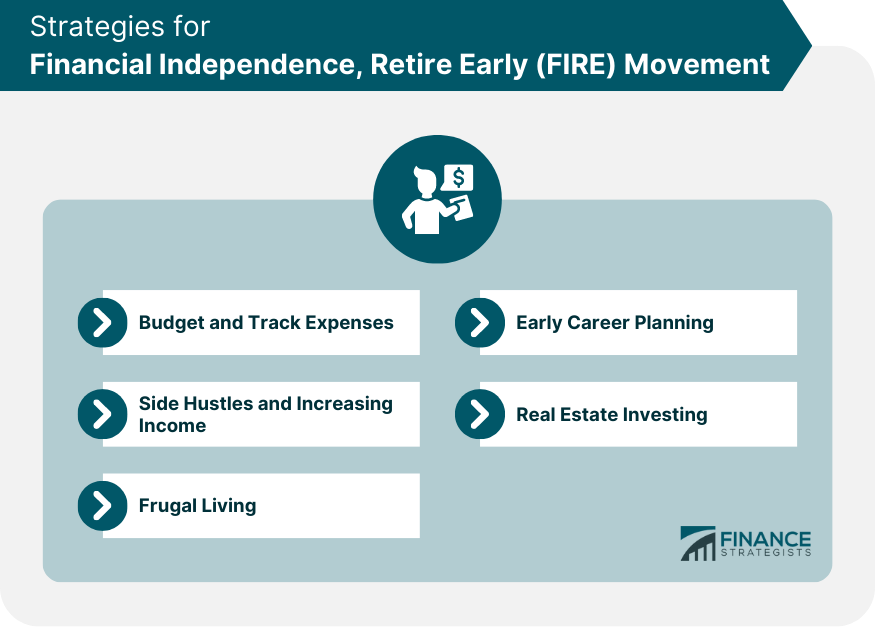

Strategies for Achieving Financial Independence

The journey to financial independence requires a toolbox of strategies designed to optimize spending, savings, and investment returns. Here are some effective strategies that can help pave your way to freedom:

- Budgeting: Create a clear and realistic budget that accounts for all your expenses, including fixed costs, variable expenses, and discretionary spending. The goal is to identify areas where you can cut back and funnel those savings into investments.

- High Savings Rate: To achieve financial independence quickly, aim for a savings rate of 50% or more. This might necessitate lifestyle changes, such as downsizing your home or reducing vacation expenses.

- Invest Wisely: Learn about investment options that align with your risk tolerance and financial goals. Whether it’s stocks, bonds, real estate, or mutual funds, diversifying your investment portfolio is key to financial growth.

- Passive Income Streams: Explore ways to generate passive income through rental properties, dividend stocks, or side hustles that require minimal effort once they are set up.

- Community Engagement: Engage with like-minded individuals in the FIRE community. Sharing experiences and strategies can offer new perspectives and enhance motivation.

The FIRE movement ultimately challenges societal norms surrounding work and retirement. It signals a shift toward empowerment, where individuals take control of their financial futures. By adopting disciplined financial habits and leveraging the tools at our disposal, the dream of retiring early can become a reality, offering the chance to pursue passions and interests beyond the constraints of a traditional job.

As you consider embarking on this transformative journey, remember that the path to financial independence is uniquely personal. Your goals, values, and circumstances will shape the strategies you employ. Whether you aspire to fully retire in your 30s or simply want to achieve a greater degree of financial freedom, every small step counts towards that ultimate goal. With determination and careful planning, financial independence is within reach.