Best Saving Accounts With High Interest Rates Savings interest rates infogram

In today’s fast-paced world, understanding the finance landscape is essential. As we navigate through different options for saving money, high-yield savings accounts have garnered rising attention. They offer attractive interest rates that can help you maximize your money. With the evolution of financial products and the competitive nature of banks, it’s crucial to stay informed about the best interest rates for savings accounts. Let’s delve into some of the interesting aspects surrounding this topic.

Best Interest Rates For Savings Accounts 2024 Olympics

The year 2024 brings exciting prospects, especially for those looking to capitalize on high-yield savings accounts. As financial institutions strive to entice customers, the rates they offer can significantly impact your saving strategy. High-yield savings accounts are not only a safe place to store your money, but they can also yield substantial interest, especially during high-demand periods like the Olympics year.

People across the globe are likely gearing up for the events that the Olympics will bring. However, it’s also a time when financial planning becomes crucial, especially for individuals looking to save more effectively. Banks may offer promotional rates or enhanced benefits leading up to the games to attract new customers. Keeping an eye on these evolving rates can be beneficial for anyone looking to make their savings work harder.

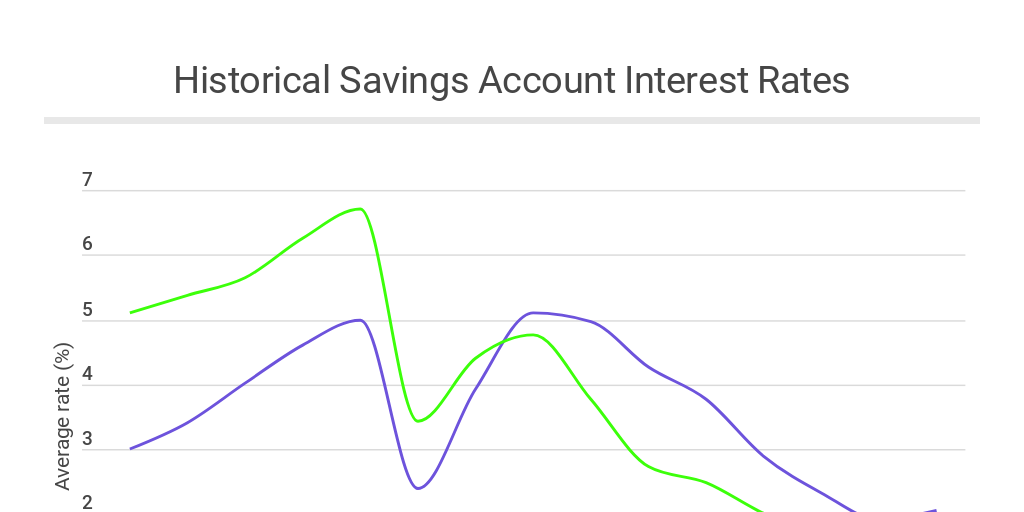

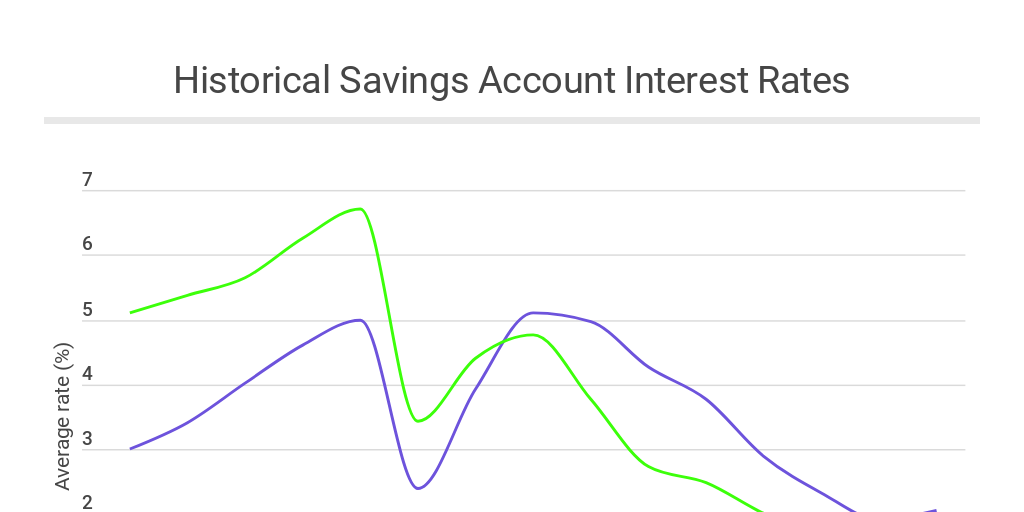

Historical Savings Account Interest Rates

Understanding historical trends in savings account interest rates can offer insights into future movements. Over the years, we have witnessed fluctuations that align with broader economic changes. For instance, during times of economic downturn, interest rates may dip, prompting consumers to seek alternatives. Conversely, in a booming economy, banks are more inclined to offer higher rates to encourage saving among consumers.

When analyzing these trends, it’s essential to consider factors such as inflation, federal reserve interest rates, and overall economic conditions. Historical data serves as a guideline, showing how banks have reacted to market dynamics in the past. However, while historical data is informative, it should be noted that it does not guarantee future performance. Each financial institution operates within its own policies and market influence.

Finding the right savings account requires some due diligence. While interest rates are a primary factor, consider other aspects such as account fees, required minimum balances, ease of access, and additional perks offered by the bank. The right combination could enhance your saving experience significantly.

With all this in mind, let’s look further into why a high-yield savings account could be a smart choice, especially during dynamic economic times. It’s an excellent way to build a financial cushion while still having access to your funds when needed. By understanding how to leverage your savings effectively, you can ensure that your money works for you rather than remaining stagnant.

High-yield savings accounts can serve not just as a means to save, but also as a strategy for emergency funds or future investments. They provide both liquidity and competitive interest rates, and with the right amount of commitment, you may find yourself in an excellent position come 2024 and beyond.

In summary, as we look ahead to the financial landscape, let’s keep these aspects in focus. The savings account options are abundant, and understanding how they work will empower you to make informed decisions that align with your financial goals. Whether you are saving for a big event like the Olympics or establishing a safety net, the right high-yield savings account can work to your advantage.

This HTML formatted content provides insights into high-yield savings accounts, incorporating the images and alt text as per your request while also maintaining an informative tone. The body of the text emphasizes understanding financial products while also motivating readers to consider their options carefully.