How To Create A Balanced Investment Portfolio Sample balanced portfolio — ferguson wellman

Investing wisely is one of the most crucial skills one can develop over a lifetime. When it comes to building a balanced portfolio, it’s essential to diversify your assets to minimize risk while maximizing potential growth. Here, we’ll explore what a balanced portfolio looks like and provide you with some visual references to help you understand various asset allocations.

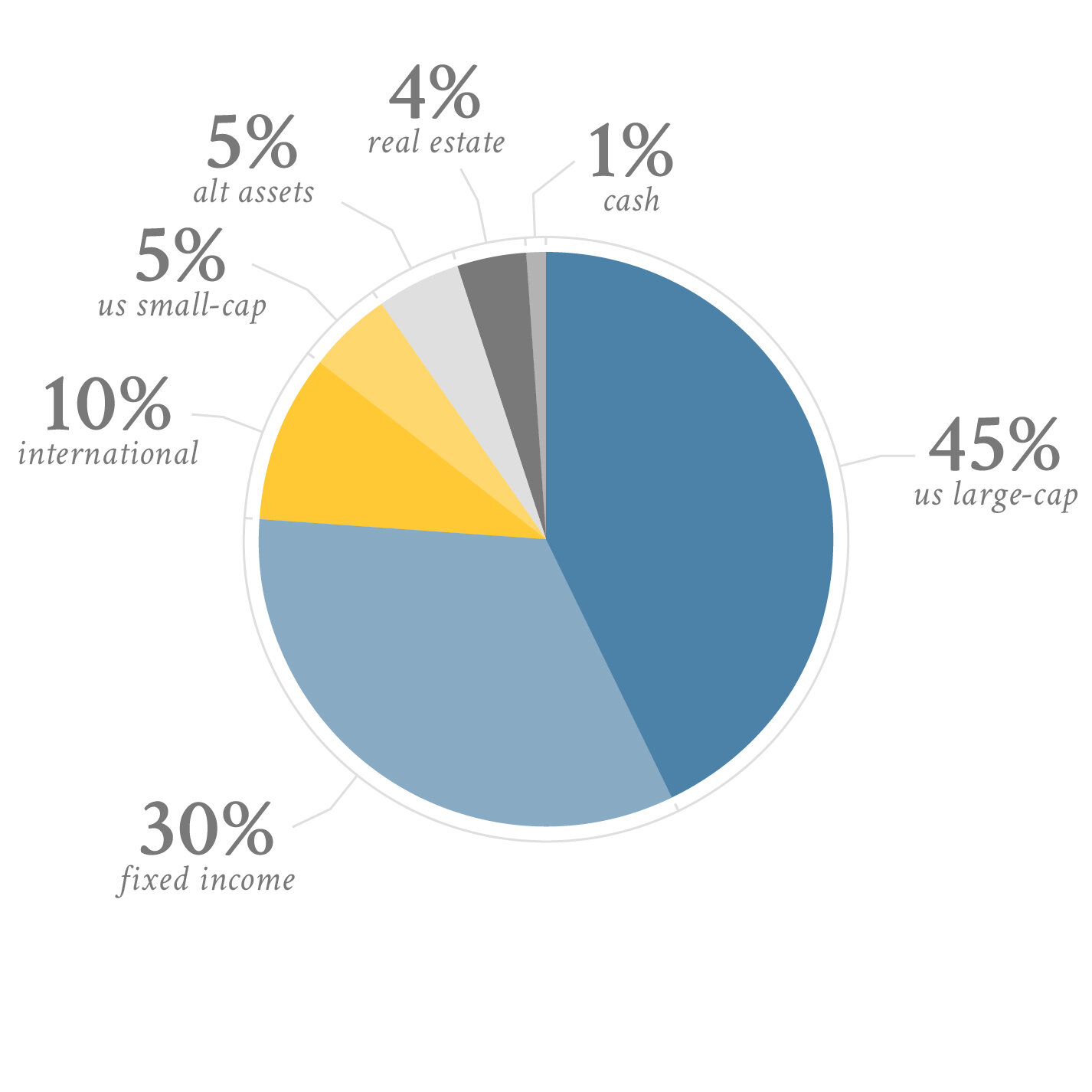

Modus Balanced Portfolio Financial Investment

The Modus Balanced Portfolio is an excellent starting point for anyone looking to understand the essentials of portfolio management. This image illustrates how a balanced portfolio typically distributes investments across different asset classes. By allocating funds across stocks, bonds, and other investment vehicles, you can create a buffer against market volatility. A balanced approach allows for potential capital growth while attempting to manage risk effectively.

When examining the pie chart, you will notice a reasonably even distribution between equities and fixed income, alongside a small allocation in alternative investments. This structure permits exposure to higher returns while still maintaining a safety net in less volatile options. Managing your risk is a continuous process that entails regularly revisiting your asset allocation to ensure it aligns with your investment goals and risk tolerance.

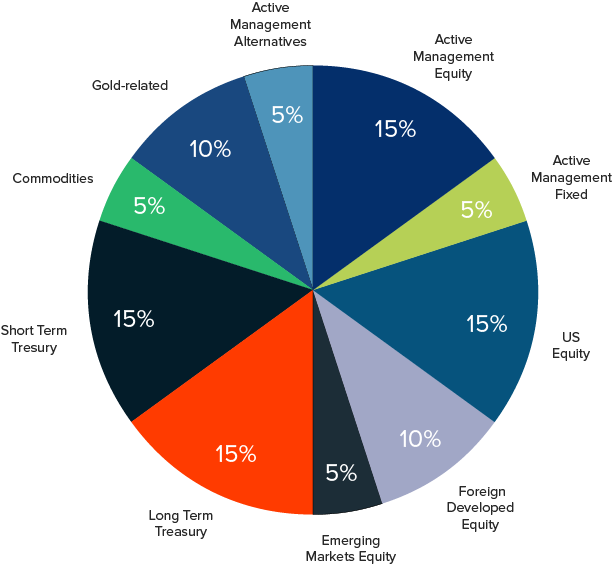

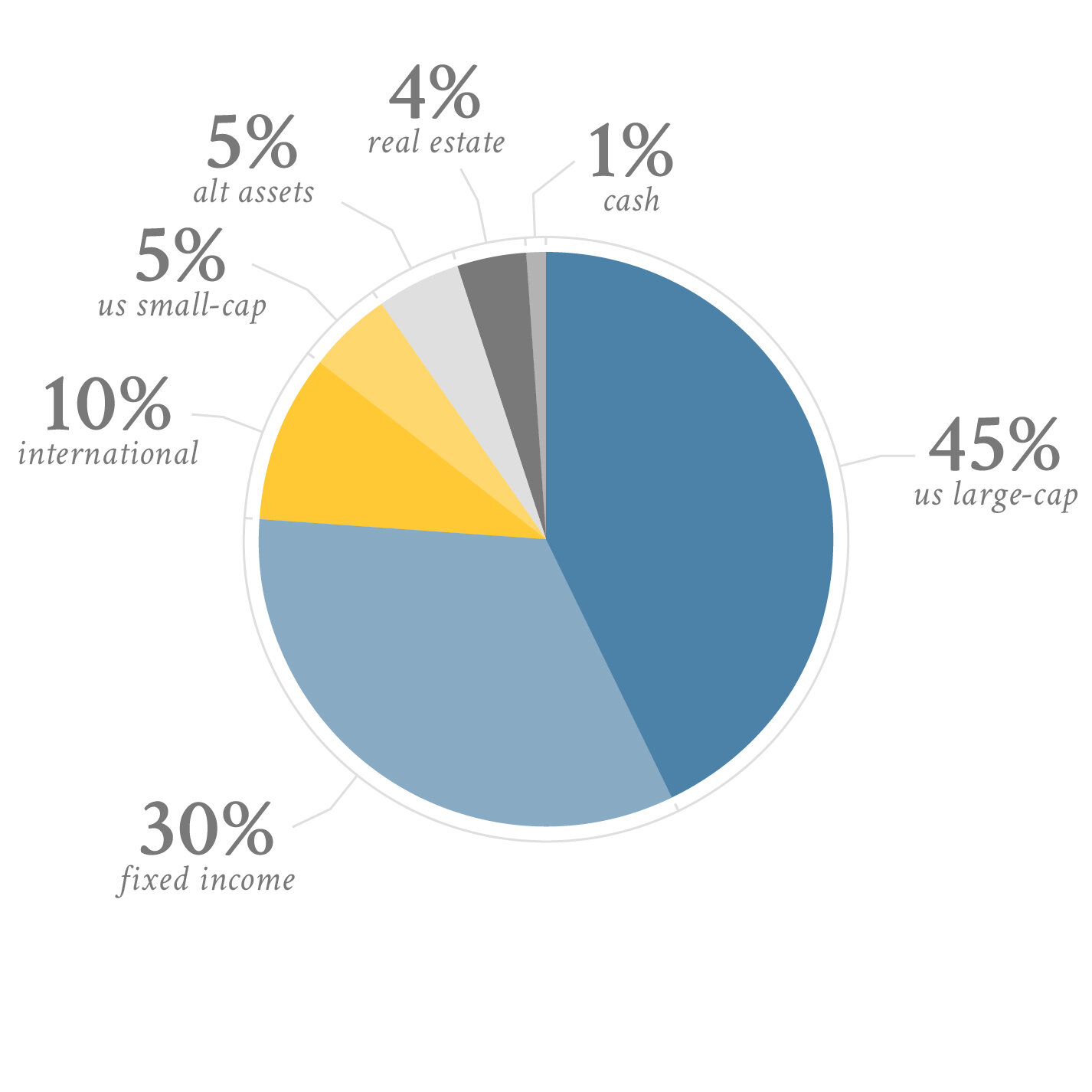

Sample Balanced Portfolio

This sample balanced portfolio image presents another approach to asset allocation. Here, you can see how a slightly varied distribution could offer different benefits. The allocation model includes equities, fixed income, and cash equivalents. In times of economic uncertainty, having liquid assets can be a lifesaver, allowing you to seize opportunities or cover unexpected expenses.

The chart shows a different breakdown, suggesting that not all balanced portfolios look alike. Some investors may prefer a greater emphasis on stocks, especially in a bullish market, while others may choose to lean more heavily into bonds to preserve capital. Understanding these allocations and how they relate to one another is critical for anyone aiming to create a portfolio that mirrors their individual aspirations and comfort levels.

The Importance of Diversification

Diversification is at the heart of building a balanced portfolio. It helps mitigate risk because not all asset classes will react to market events similarly. For instance, equities may soar when the economy is booming, whereas bonds might become more attractive during recessions. By spreading investments across different asset classes, you reduce the adverse effects of a downturn in any single area.

Consider a conventional approach: if half of your portfolio is in growth stocks while the rest is in bonds, you’re likely to fare better than someone whose entire investment is tied to an individual stock. Not only does this strategy help buffer your investments from market fluctuations, but it also presents opportunities for performance during different market conditions.

The Role of Your Investment Goals

Your investment goals profoundly influence your portfolio’s structure. If you’re a younger investor with a long time horizon, it may make sense to have a higher equity allocation. In contrast, if you’re nearing retirement, you might prioritize fixed income and stable investments to preserve your capital.

It’s important to regularly assess your financial goals. Life changes, such as marriage, buying a home, having children, and nearing retirement, can all prompt revisions in your investment strategy. Make it a habit to evaluate your goals at least annually and adjust your portfolio accordingly.

Common Portfolio Types

Here are some common types of balanced portfolios and their characteristics:

- Conservative Portfolio: Typically includes a higher percentage of bonds and cash equivalents. The aim is to preserve capital while generating moderate returns.

- Moderate Portfolio: A mix of stocks and bonds, usually around 60% stocks and 40% bonds. This person balances growth and income while accepting a manageable level of risk.

- Aggressive Portfolio: Primarily consists of stocks (approximately 80% or more) due to the investor’s desire for significant growth. This strategy comes with higher risk as market fluctuations are more pronounced.

Monitoring Your Portfolio

One of the keys to successful investing is monitoring your portfolio regularly. Are you achieving the returns you expect? Is your allocation still aligned with your goals? Remember, shifts in market conditions or changes in your life can necessitate adjustments.

Many people make the mistake of setting up their investments and then forgetting about them. A balanced portfolio requires active management. This doesn’t mean you need to make frequent trades, but stay engaged with your investments, and be prepared to make changes as needed.

Tools for Portfolio Management

In the digital age, numerous portfolio management tools can help streamline this process. Traditional brokers, robo-advisors, and investment tracking apps provide user-friendly platforms where you can visualize the performance of your assets.

These tools often come with analytical capabilities to help you understand the performance of various investment types compared to benchmarks. Importantly, they’ll also assist in rebalancing your portfolio as you make adjustments over time, ensuring you remain on track toward achieving your financial goals.

Preparing for Economic Changes

Economic conditions can significantly impact your investments. For instance, during a recession, people tend to pull back on spending, affecting numerous industries. Alternatively, a booming economy can lead to strong corporate earnings and rising stock prices. Understanding how different sectors react to economic shifts is a way to navigate potential downturns and capitalize on favorable markets.

Learning and Adapting

Lastly, ongoing education is essential. The investment landscape continually evolves, influenced by regulatory changes, technological advancements, and market trends. Attend seminars, read financial literature, and engage with professionals to expand your understanding. Investors who embrace learning are often more successful in adapting their strategies when necessary.

Building a balanced portfolio may seem daunting at first, but with the right tools and knowledge, it becomes an achievable goal. Through careful consideration of your risk tolerance and investment objectives, and with the visual references provided, you can take significant strides toward crafting an effectively balanced investment strategy.