Passive Income Streams 2025 Best passive income streams 2025

As we navigate through the ever-evolving landscape of finance and investment, the concept of passive income has become more appealing than ever. Many of us dream of earning money while we sleep, and with the right strategies, it’s entirely possible. In this post, we’ll explore some of the best passive income streams that you can start developing today to secure a stable financial future.

1. Real Estate Investment

Real estate remains a reliable source of passive income. By purchasing rental properties or investing in real estate investment trusts (REITs), you can earn money with less active management than traditional investments. The key is to choose properties in desirable locations and understand the market dynamics.

It’s essential to conduct thorough research before jumping into real estate. Look for areas with growth potential, good schools, and low crime rates. Once you have your properties, using property management services can alleviate some of the burdens and allow you to enjoy more of the returns.

2. Dividend Stocks

Investing in dividend stocks is another excellent method for generating passive income. Companies that pay dividends regularly distribute a portion of their earnings to shareholders. This means that you can earn money without having to sell your stock. Over time, as you reinvest these dividends, your investment can grow significantly.

To create a solid dividend portfolio, focus on companies with a history of consistent dividend payments and growth. Blue-chip stocks, which are shares of well-established companies, often provide reliable dividends. Additionally, consider diversifying your portfolio across various sectors to mitigate risks. Building your portfolio with the right stocks will require some initial research and monitoring, but the ongoing returns can be worthwhile.

3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms offer another unique opportunity to earn passive income. By lending money to individuals or small businesses, you can earn interest on your loans, often at rates higher than what you would receive from a traditional savings account. Platforms like LendingClub or Prosper allow you to choose your loans based on risk levels and potential returns.

However, it’s crucial to conduct due diligence. Not all borrowers will repay their loans, so diversifying your investments across multiple borrowers can help manage that risk. While P2P lending involves some level of risk, it does also offer the potential for significant rewards if managed carefully.

4. Create an Online Course

With the rise of e-learning, creating an online course has become a viable passive income stream. If you possess expertise in a particular subject—be it photography, marketing, coding, or health—you can monetize that knowledge by creating a course. Platforms such as Udemy and Coursera allow you to reach a wide audience and earn money whenever someone enrolls in your course.

The initial setup can take some time; you’ll need to create engaging content and possibly video material. However, once your course is live, it can provide a consistent stream of income as students sign up and take your course over time. Additionally, you can continually update the course or create new ones to enhance your earnings.

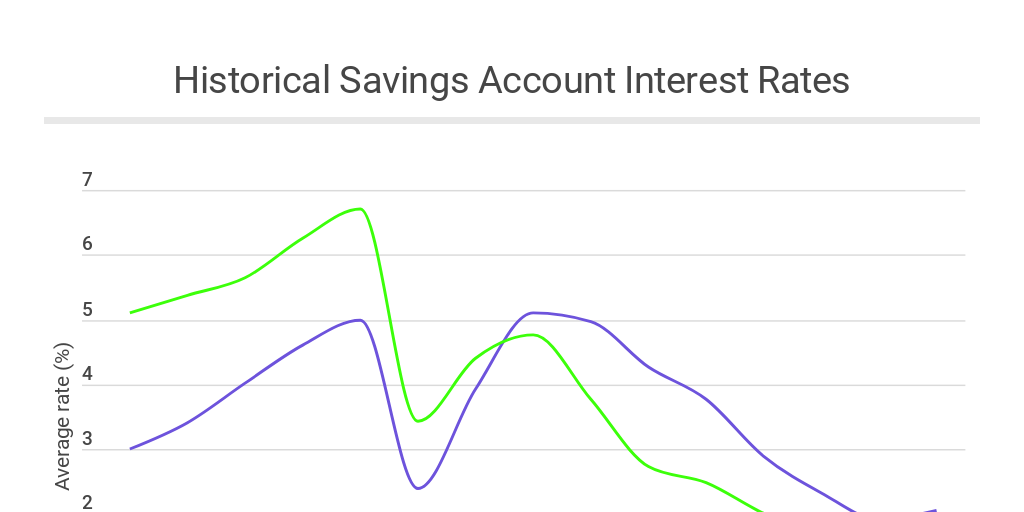

5. High-Interest Savings Accounts

It may seem simple, but having funds in high-interest savings accounts can generate passive income through accrued interest. While the returns may not be as high as other investments, it provides a safe place to park your money while still earning something on it. Look for online banks offering higher interest rates than traditional banks, as they often provide more competitive rates.

Additionally, consider setting up an emergency fund in these savings accounts. Having accessible funds means less stress during unforeseen events, while still letting your money grow slowly through interest. It’s one of the simplest forms of passive income but can be a crucial part of your overall financial strategy.

6. Write an eBook

If you have a passion for writing or expertise in a specific area, consider writing an eBook. Today’s digital platforms make it easier than ever to publish your work and reach a global audience. You can sell your eBook through Amazon Kindle Direct Publishing, or use your website to market it directly to your audience.

The key is to choose a topic that resonates with readers and fills a need or gap in the market. EBooks can continue making money long after you publish them, especially if you effectively market them through social media or other online channels. This initial effort can result in significant passive income over time.

7. Invest in a Blog or Website

Another avenue for passive income is to invest in a blog or website. By creating valuable content that attracts readers, you can monetize your blog through ads, affiliate marketing, or membership fees. Blogs focused on niches that you are passionate about can also generate a loyal readership, leading to sustained income over time.

Building a successful blog requires consistent effort in the beginning, such as writing posts, optimizing for SEO, and promoting on social media. However, once established, it can generate income passively, especially if you have tools in place that continue to drive traffic and engagement.

8. Licensing Your Photography or Artwork

If you’re a talented photographer or artist, consider licensing your work. There are numerous platforms like Shutterstock, Adobe Stock, or Etsy where you can sell licenses for your images or artwork. Once the initial work is completed and uploaded to these platforms, you can earn a commission each time someone downloads or purchases your work.

This can be a great way to turn a hobby into a revenue stream. It’s essential to consistently create and upload new content to keep your portfolio relevant and appealing to potential buyers. The more high-quality work you have available, the more potential for passive income.

9. Build an App or Software

If you have programming skills, building an app or software solution can be a lucrative passive income option. With the increasing reliance on technology, a well-developed app that solves a problem or serves a need can attract paying customers. Consider creating a subscription model where users pay a monthly fee for access or a one-time purchase fee.

The initial investment of time and possibly money in development can be significant, but once your app gains traction, it can generate recurring revenue with minimal ongoing effort. Continuous updates and customer support will be needed to maintain user satisfaction, but the potential financial rewards can be substantial.

10. Invest in Bonds

Bonds are generally considered a safer investment compared to stocks. They provide fixed interest payments over a set period, and at maturity, you get your principal back. While bonds may have lower returns compared to other options like stocks or real estate, they offer a reliable income stream, making them a solid part of your overall investment strategy.

Investors can choose between government and corporate bonds, with varying levels of risk and return profiles. The key is to balance your portfolio with a mixture of higher-risk and lower-risk investments to handle market volatility. Including bonds can help stabilize your income during uncertain economic times.

In conclusion, there are numerous pathways to building passive income, each with its own set of advantages and challenges. Start by exploring multiple streams to find what resonates with you and aligns with your financial goals. Whether it’s through investing, creating content, or leveraging your skills, the journey to earning passive income can open up a world of financial freedom and stability.