Emergency Fund Building Strategies Emergency fund building

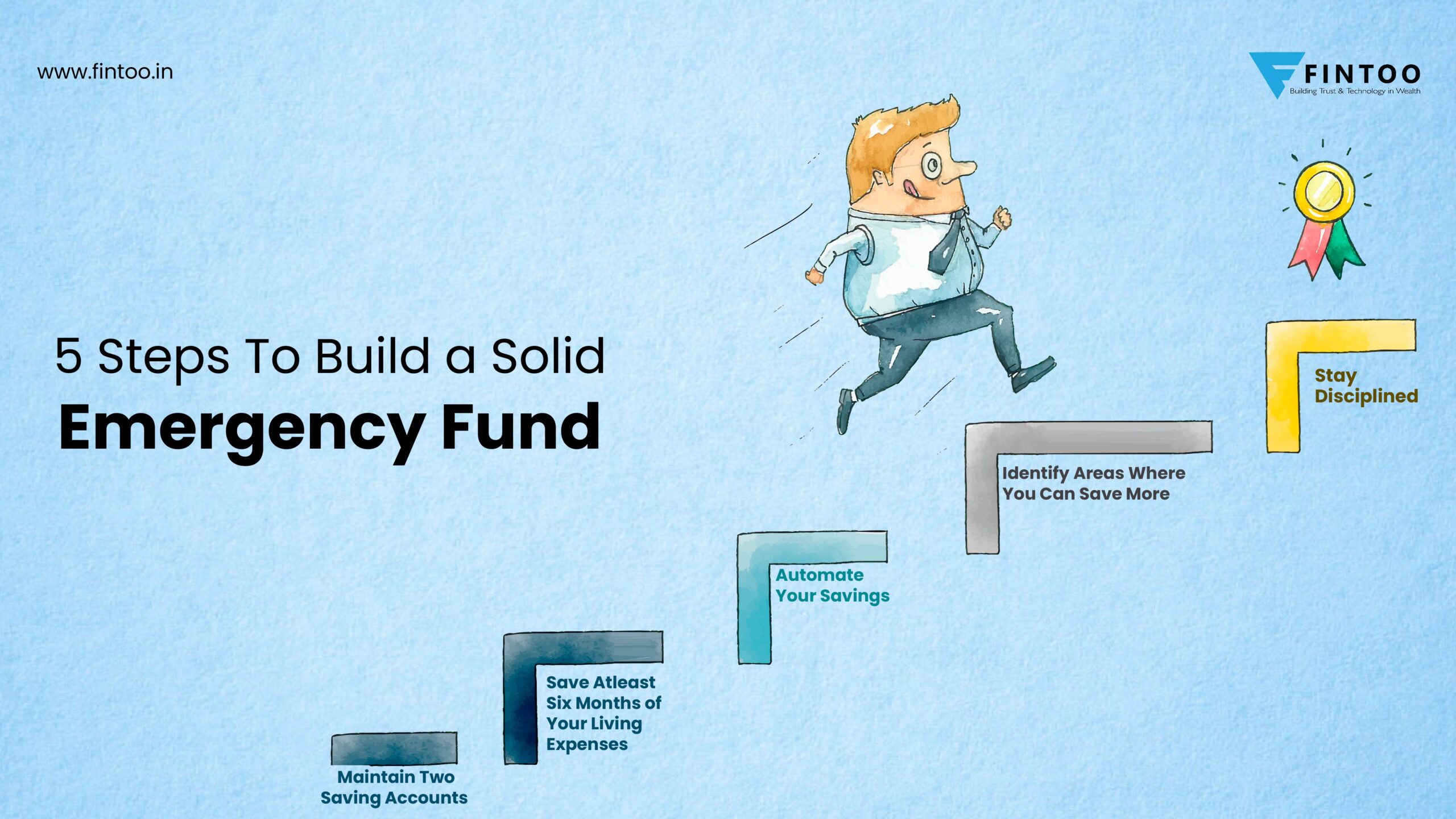

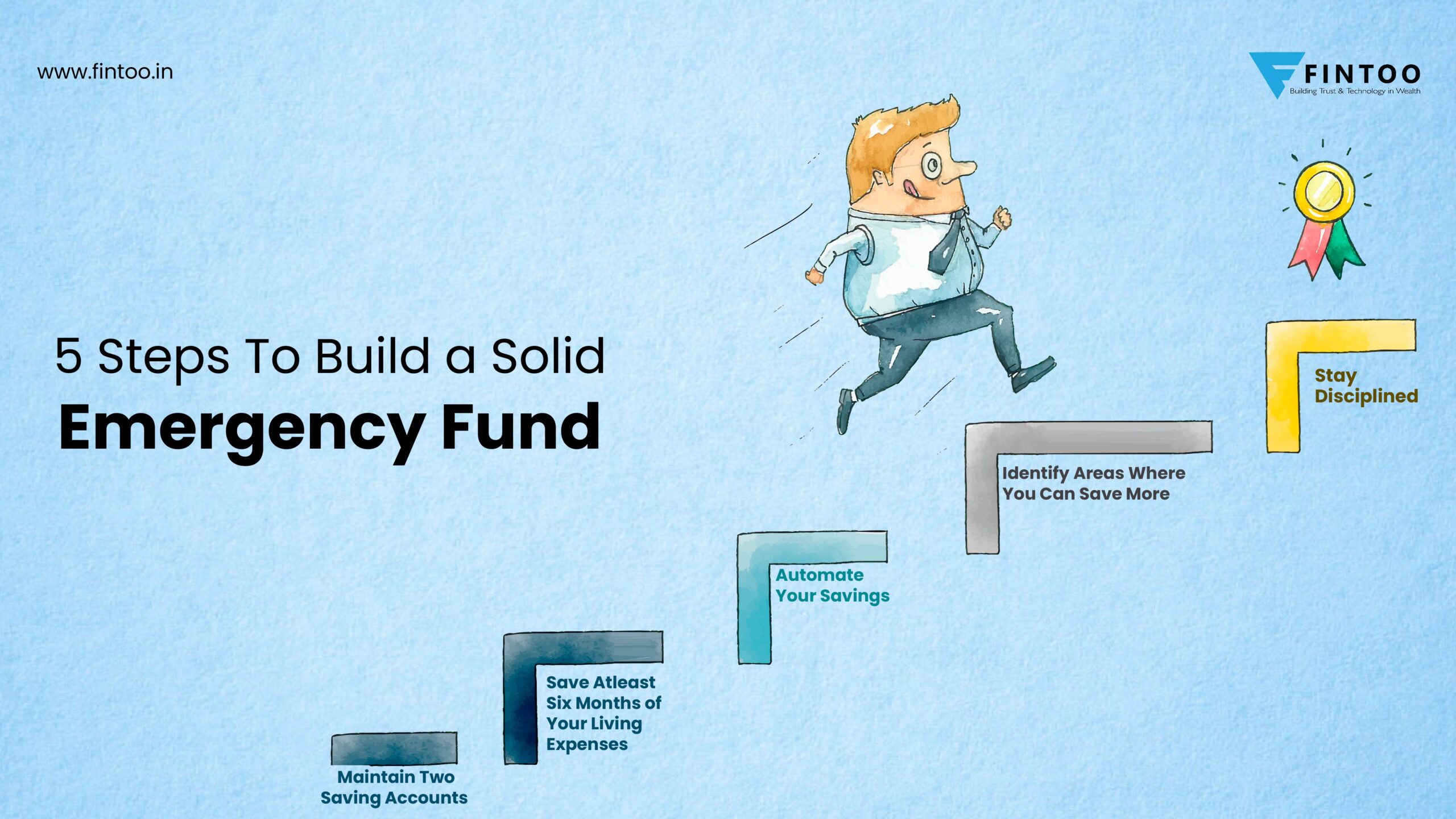

Creating a solid emergency fund is one of the most important financial steps you can take to ensure that you’re prepared for unexpected expenses. Whether it’s a medical emergency, car repairs, or a sudden loss of income, having a financial safety net can provide peace of mind. In this post, we will explore the essential steps needed to build an emergency fund, as well as the benefits of having one. Let’s dive into the details and empower ourselves with the knowledge to secure our financial future!

Step 1: Assess Your Current Financial Situation

The first step in building your emergency fund is to take a good look at your current financial situation. This means taking stock of your income, expenses, savings, and any existing debts. By understanding where you stand financially, you can determine how much money you need to save for your emergency fund. A common guideline is to aim for three to six months’ worth of living expenses. However, depending on your personal circumstances, you may want to adjust this number.

Step 2: Set a Savings Goal

Once you’ve assessed your financial situation, the next step is to set a specific savings goal. This should be a measurable amount that you aim to save over a certain period. For example, if you determine that you need $12,000 for a six-month emergency fund and you want to achieve this goal in one year, you would need to save $1,000 per month. Setting a realistic and achievable goal will keep you motivated and accountable as you work toward building your fund.

Step 3: Create a Budget

With a savings goal in place, it’s time to create a budget that aligns with your financial goals. Review your monthly income and expenses, identifying areas where you can cut back on discretionary spending. This could mean dining out less frequently, canceling unused subscriptions, or finding cheaper alternatives for everyday items. By reallocating these funds toward your emergency savings, you can steadily work towards your goal.

Step 4: Automate Your Savings

One of the most effective ways to build your emergency fund is by automating your savings. Setting up automatic transfers from your checking account to a dedicated savings account each month can help you reach your goal without even thinking about it. Treat your savings like a recurring bill that needs to be paid, and prioritize it in your budget. This helps ensure that you save consistently, making it easier to build your fund over time.

Step 5: Choose the Right Savings Account

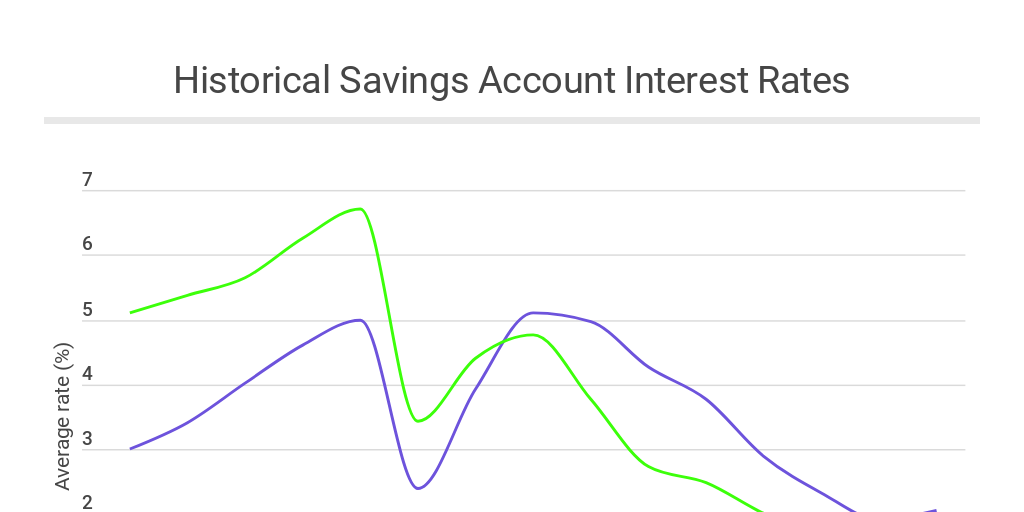

Choosing the right account for your emergency fund is essential to maximize your savings potential. Traditional savings accounts typically offer low-interest rates, which may not keep up with inflation. Consider exploring high-yield savings accounts or money market accounts that provide higher interest rates for your saved money. Look for accounts with no monthly fees and convenient access to your funds when needed.

The Importance of Having an Emergency Fund

Having an emergency fund is not just about having money saved for a rainy day; it’s about financial stability and peace of mind. With an emergency fund in place, you won’t have to rely on credit cards or loans that can lead to debt. You can cover unexpected expenses without derailing your financial plans, allowing you to focus on your long-term goals.

Tips for Maintaining Your Emergency Fund

Building an emergency fund is just the beginning; it’s essential to maintain it as well. Here are some tips on how to keep your emergency fund intact:

- Replenish After Use: If you ever need to dip into your emergency fund, make it a priority to replenish it as soon as possible. Plan how you will save the amount back over the following months.

- Review Regularly: Life changes and so do your financial needs. Regularly review your emergency fund to ensure it’s still aligned with your current living expenses.

- Keep it Separate: To avoid the temptation of using your emergency fund for non-emergency expenses, keep it in a separate savings account reserved only for emergencies.

- Consider Inflation: Over time, the cost of living may rise, so ensure your fund keeps up by adjusting your savings goals accordingly.

Conclusion

In conclusion, building a solid emergency fund is vital for financial security. It involves assessing your current situation, setting a savings goal, creating a budget, automating your savings, and choosing the right account. By following these steps and maintaining your fund, you can be better prepared for whatever life throws your way. Remember, the journey to financial security starts with small steps today that leads to a bigger, more stable future tomorrow. Happy saving!