Best Investment Strategies For 2025 Investment strategies – strategic africa investment group

In today’s dynamic financial landscape, understanding various investment strategies is crucial for stakeholders aiming to navigate the complexities of the market. In this article, we will explore two noteworthy resources that highlight significant investment strategies, offering insights and guidance for both novice and experienced investors.

Investment Strategies – Strategic Africa Investment Group

The image presented encapsulates the essence of strategic investment approaches. It is vital to recognize that in the realm of investment, adopting a well-structured strategy is not just beneficial; it is paramount. The Strategic Africa Investment Group emphasizes the importance of analyzing regional trends and opportunities that can yield significant returns, particularly in emerging markets.

Investors are increasingly being directed towards sectors where growth potential aligns with their risk tolerance. Understanding the political, economic, and environmental contexts of investments, particularly in Africa, can provide investors with an edge. Employing tailored strategies to fit particular sectors—whether it be technology, agriculture, or renewable energy—can unlock lucrative opportunities.

Moreover, the dynamic nature of African markets requires investors to remain adaptable. Strategies that incorporate flexibility can help in responding to rapidly changing circumstances, ensuring that potential risks are managed effectively while pursuing rewards.

20 Investment Strategies available to Investors [Clear Finances]

![20 Investment Strategies available to Investors [Clear Finances]](https://www.clearfinances.net/wp-content/uploads/2020/11/20-Investment-Strategies.png)

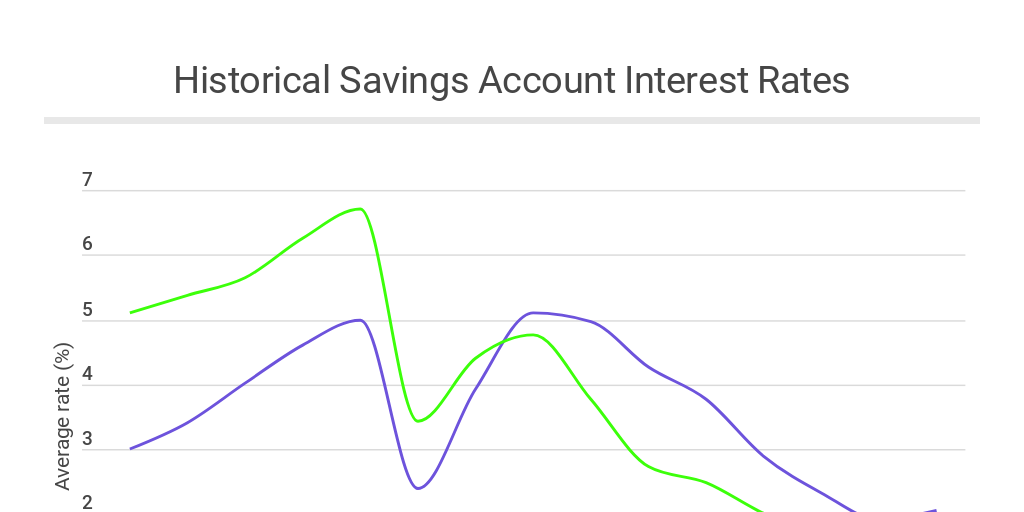

This visual representation illustrates a spectrum of investment strategies available to investors today. From traditional stock market investments to innovative alternatives, the options are diverse and plentiful. Each strategy carries its unique benefits and risks, catering to a variety of investor objectives and profiles.

One prominent strategy includes dollar-cost averaging, which enables investors to mitigate volatility by spreading their investment amount across regular intervals. This approach offers protection against market fluctuations and instills discipline in investment habits.

Another strategy highlighted involves diversifying portfolios. A well-diversified portfolio can reduce risk and volatilities, allowing investors to balance potential losses in one sector with gains in another. Utilizing a mix of asset classes—such as stocks, bonds, and real estate—can lead to more stable asset performance over time.

The use of index funds is also gaining traction among investors looking for lower management fees and passive investment strategies. Index funds track specific market indices, offering investors exposure to a wider market segment without the need for active management.

Additionally, alternative investments such as real estate, private equity, and commodities can serve as effective diversification tools. These asset classes often behave differently than traditional stocks and bonds, which can enhance portfolio resilience against downturns.

In summation, understanding and implementing various investment strategies is essential for building a robust financial future. The resources examined showcase the significance of strategic planning, adaptability to market conditions, and the necessity of diversifying investment portfolios. Whether one is taking their first steps into investing or looking to refine their existing strategies, an informed approach will facilitate smarter decisions and potentially greater financial success.

As the investment landscape continues to evolve, remaining educated about the latest strategies and market insights is essential. Both resources serve as valuable tools for guiding investors in making informed choices tailored to their individual financial goals.